| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Humana (HUM) is a health care company. It offers a range of insurance products, and health and wellness services that incorporate an integrated approach to lifelong well-being.

Humana (HUM) is a health care company. It offers a range of insurance products, and health and wellness services that incorporate an integrated approach to lifelong well-being.

The company operates in three segments: Retail, Employer Group, and Healthcare Services. Its Retail segment provides Medicare and commercial fully-insured medical and specialty health insurance benefits, including dental, vision, and other supplemental health and financial protection products directly to individuals. This segment has contract with Centers for Medicare and Medicaid Services to administer the Limited Income Newly Eligible Transition program and state-based Medicaid businesses. The companys Employer Group segment provides Medicare and commercial fully-insured medical and specialty health insurance benefits, as well as administrative services only products, and health and productivity solutions directly to employer groups. Its Healthcare Services segment offers services to its health plan members, as well as to third parties, including provider services, pharmacy, integrated behavioral health services, and home care services. The companys Other Businesses category consists of military services, primarily its TRICARE South Region contract; Puerto Rico Medicaid; and closed-block long-term care businesses. As of December 31, 2012, Humana Inc. had approximately 12.1 million members enrolled in medical benefit plans; and approximately 8.1 million members enrolled in specialty products programs.

Shares are lower today after Minnesota Attorney General Lori Swanson today said she had uncovered "significant problems" with the company's Medicare Advantage policies, the Star Tribune reported. Medicare Advantage is a form of Medicare administered by private companies. Affidavits from 25 Minnesotans suggested that claims were frequently denied for medical services required by law, while beneficiaries were frequently overcharged, the newspaper stated. Swanson said she had written to federal regulators about the complaints, it added.

Wells Fargo says the near-term pressure on Humana shares could grow after Minnesota's Attorney General requested that the company be investigated for ''significant problems'' reported in the state. Wells said it appears the issue is limited to Humana, though it is unclear if the issue is limited to plans in Minnesota or if these issues are more widespread for the company.

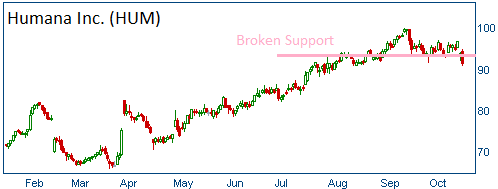

Shares have fallen below a support level.

52-Week Trading Range: $63.93 - $99.85

Last Trade: $91.36

Trade

Profit/Loss Analysis

Closing Summary

|

|