| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

FLIR Systems (FLIR) designs, manufactures, and markets thermal imaging systems worldwide.

FLIR Systems (FLIR) designs, manufactures, and markets thermal imaging systems worldwide.

The company operates in five segments: Thermal Vision & Measurement (TVM), Raymarine, Surveillance, Detection, and Integrated Systems.

The TVM segment provides thermal imaging and night vision systems, personal vision thermal cameras, cameras and imaging algorithms, hand-held systems, infrared imagers, and test equipment; and camera cores, sensors, and readout integrated circuits, as well as offers training services. The Raymarine segment provides marine electronics comprising multifunction displays, autopilot systems, thermal imaging cameras, radars, sonar modules, connectivity software, and other instruments to monitor boat speed, direction, and location. The Surveillance segment offers imaging and recognition solutions for a range of applications consisting of force protection, drug interdiction, search and rescue, special operations, and target designation, as well as for the intelligence, surveillance, and reconnaissance. The Detection segment provides sensor instruments that detect and identify chemical, biological, radiological, nuclear, and explosives threats for military force protection, homeland security, and commercial applications. The Integrated Systems manufactures and markets mobile and fixed solutions for perimeter surveillance. This segments products include Cerberus mobile unmanned towers and manned SkyWatch towers for protecting borders, securing facilities, protecting forces, and safeguarding the public.

It also offers Cohesion, an integration software to support or integrate with sensors and devices; and Cameleon, a video integration software for monitoring and controlling video surveillance camera networks.

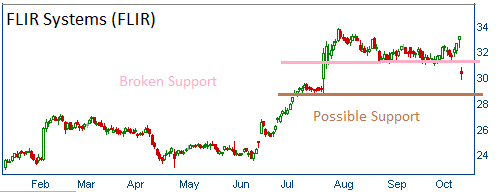

Firm warned of lower earnings this morning. Shares have fallen through a support level following the news. Lower share prices are expected for FLIR.

52-Week Trading Range: $18.58 - $33.81

Last Trade: $30.48

Here is the trade:

Trade

Profit/Loss Analysis

Closing Summary

|

|

We are closing FLIR option trade with great results.