Put Options on RL on 10/31/2012

Ralph Lauren Corporation is engaged in the design, marketing and distribution of products, including men’s, women’s and children’s  apparel, accessories (including footwear), fragrances and home furnishings. The Company operates in three segments: Wholesale, Retail and Licensing. Its apparel products include a range of men’s, women’s and children’s clothing. Accessories include a range of footwear, eyewear, watches, jewelry, hats, belts and leather goods, including handbags and luggage. The Company’s coordinated home products include bedding and bath products, furniture, fabric and wallpaper, paint, tabletop and giftware. Its Brands and Products include Ralph Lauren Purple Label, Ralph Lauren Men’s Black Label, Lauren for Men, Ralph by Ralph Lauren, Ralph Lauren Women’s Collection, Ralph Lauren Women’s Black Label, Ralph Lauren Blue Label, Lauren by Ralph Lauren, Pink Pony, RRL, Ralph Lauren Denim & Supply, Polo Jeans Co., Golf, Rugby, Ralph Lauren Children’s wear and Ralph Lauren Watches.

apparel, accessories (including footwear), fragrances and home furnishings. The Company operates in three segments: Wholesale, Retail and Licensing. Its apparel products include a range of men’s, women’s and children’s clothing. Accessories include a range of footwear, eyewear, watches, jewelry, hats, belts and leather goods, including handbags and luggage. The Company’s coordinated home products include bedding and bath products, furniture, fabric and wallpaper, paint, tabletop and giftware. Its Brands and Products include Ralph Lauren Purple Label, Ralph Lauren Men’s Black Label, Lauren for Men, Ralph by Ralph Lauren, Ralph Lauren Women’s Collection, Ralph Lauren Women’s Black Label, Ralph Lauren Blue Label, Lauren by Ralph Lauren, Pink Pony, RRL, Ralph Lauren Denim & Supply, Polo Jeans Co., Golf, Rugby, Ralph Lauren Children’s wear and Ralph Lauren Watches.

Stockwinners is bearish on this name for the following reasons:

- This stock is highly valued compared to some of its peers such as Coach or Burberry

- The overall global growth slowdown has hurt this stock and earnings are going to show this impact

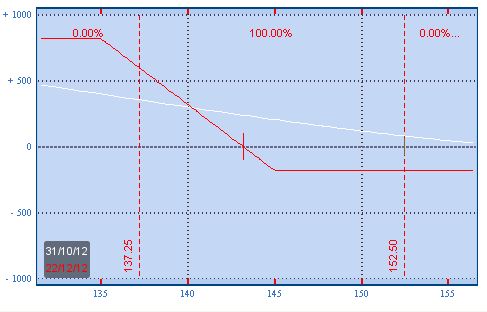

Trade: Buy 1 Dec 150/145 put spread for less than: 1.65

- Buy 1 Dec 150 Put for 6.40

- Sell 1 Dec 145 Put for 4.75

Breakeven & profit/loss analysis:

- Breakeven at 148. 35 by Dec expiration

- Profit up to 3.35 between 148.35 and 145 , Max Profit 3.35 below 145

- Lose up to 1.65 between 148.35 and 150 , Max loss 1.65 above 150

The payoff graph is presented below:

Trade

- Buy 1 December $150.00 Put at $6.40

- Sell 1 December $145.00 Put at $4.75

- For a net debit of $1.65

Profit/Loss Analysis

- Breakeven at $148.35

- Maximum profit is $335.00 at strike of $145.00

- Maximum loss is ($165.00) at strike of $150.00

Closing Summary

- Sold 1 December $150.00 Put at $0.00

- Bought 1 December $145.00 Put at $0.00

|

|

Position closed on 1/2/2013 at price of $0.00 with a -100.00% loss in 63 days.