| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

ConAgra Foods (CAG) operates as a food company primarily in North America.

ConAgra Foods (CAG) operates as a food company primarily in North America.

The company operates through four segments: Consumer Foods, Commercial Foods, Ralcorp Food Group, and Ralcorp Frozen Bakery Products. The Consumer Foods segment provides branded, private brand, and customized food products in various categorie. This segments principal brands include Alexia, ACT II, Banquet, Blue Bonnet, Chef Boyardee, DAVID, Egg Beaters, Healthy Choice, Hebrew National, Hunts, Marie Callenders, Odoms Tennessee Pride, Orville Redenbachers, PAM, Peter Pan, Reddi-wip, Slim Jim, Snack Pack, Swiss Miss, Van Camps, and Wesson.

The Commercial Foods segment offers commercially branded foods and ingredients that are sold primarily to foodservice, food manufacturing, and industrial customers. It provides specialty potato products, milled grain ingredients, vegetable products, seasonings, blends, and flavors under the ConAgra Mills, Lamb Weston, and Spicetec Flavors & Seasonings brand names. The Ralcorp Food Group segment principally offers private brand food products that are sold in various retail and foodservice channels. Its products consist of cereal products; snacks, sauces, and spreads; and pasta. The Ralcorp Frozen Bakery Products segment primarily offers private brand frozen bakery products that are sold in various retail and foodservice channels. This segment's primary products comprise frozen griddle products, including pancakes, waffles, and French toast; frozen biscuits and other frozen pre-baked products, such as breads and rolls; and frozen and refrigerated dough products.

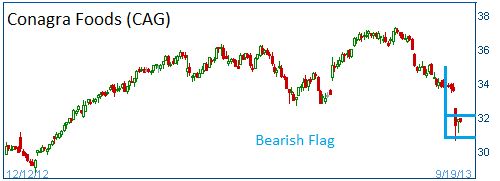

Shares have formed a bearish Flag after the firm reported warned of lower earnings. Lower share prices are expected for this stock.

52-Week Trading Range: $25.50 - $37.28

Last Trade: $31.76

Here is the trade:

Buy One October $32 Put option for less than $1.00

Here is the payoff chart:

Trade

Profit/Loss Analysis

Closing Summary

|

|