Put Options on UPS on 10/22/2012

The ubiquitous Brown is more than chocolate-colored trucks or a plain-vanilla delivery business. United Parcel Service (UPS) is the  world's largest package delivery company, transporting more than 15 million packages and documents per business day throughout the US and to 220-plus countries. Its delivery operations use a fleet of more than 100,000 motor vehicles and 500-plus aircraft. In addition to package delivery, the company offers services such as logistics and freight forwarding through UPS Supply Chain Solutions, and less-than-truckload (LTL) and truckload (TL) freight transportation through UPS Freight. UPS is acquiring TNT Express for about $6.8 billion

world's largest package delivery company, transporting more than 15 million packages and documents per business day throughout the US and to 220-plus countries. Its delivery operations use a fleet of more than 100,000 motor vehicles and 500-plus aircraft. In addition to package delivery, the company offers services such as logistics and freight forwarding through UPS Supply Chain Solutions, and less-than-truckload (LTL) and truckload (TL) freight transportation through UPS Freight. UPS is acquiring TNT Express for about $6.8 billion

Stockwinners is bearish on this name for the following reasons:

- Shares have formed a descending triangle

- Diesel demand is down and also demand for transport trucks is a low

- Shipping results have been weak

- Similar to FedEx or Deutsche Post, UPS has a rich valuation and has some room for correction

Note: UPS is announcing its earning tomorrow which adds additional risk to this trade

Trade: Buy 1 Nov $70 Put for less than $1.20

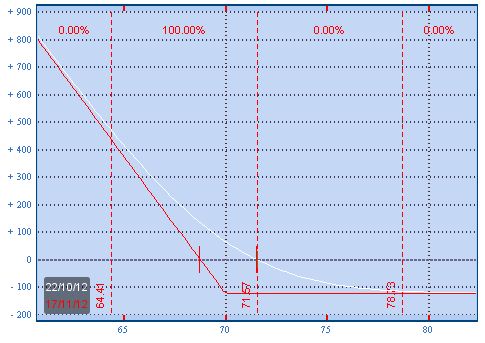

Breakeven & profit/loss analysis

- Breakeven at $68.80 by Nov expiration

- Profit below $68.80, Max profit is $68.80 if stock goes down to zero.

- Lose up to $1.20 between $70 and $68.80 , max loss $1.20 above $70

The payoff table is presented below:

Trade

- Buy 1 November $70.00 Put at $1.20

- For a net debit of $1.20

Profit/Loss Analysis

- Breakeven at $68.80

- Maximum profit is unbounded

- Maximum loss is ($120.00) at strike of $70.00

Closing Summary

- Sold 1 November $70.00 Put at $0.00

|

|

Position closed on 11/21/2012 at price of $0.00 with a -100.00% loss in 30 days.