Ratio Spread on AMZN on 10/3/2012

(AMZN)What began as Earth's biggest bookstore has become Earth's biggest everything store. Expansion has propelled Amazon.com in  innumerable directions. While the website still offers millions of books, movies, games, and music, electronics and other general merchandise categories, including apparel and accessories, auto parts, home furnishings, health and beauty aids, toys, and groceries ring up about 60% of sales. Shoppers can also download e-books, games, MP3s, and films to their computers or handheld devices, including Amazon's own portable e-reader, the Kindle. Amazon also offers products and services, such as self-publishing, online advertising, e-commerce platform, hosting, and a co-branded credit card.

innumerable directions. While the website still offers millions of books, movies, games, and music, electronics and other general merchandise categories, including apparel and accessories, auto parts, home furnishings, health and beauty aids, toys, and groceries ring up about 60% of sales. Shoppers can also download e-books, games, MP3s, and films to their computers or handheld devices, including Amazon's own portable e-reader, the Kindle. Amazon also offers products and services, such as self-publishing, online advertising, e-commerce platform, hosting, and a co-branded credit card.

StockWinners is bullish on this name for the following reasons:

- Their new streaming video library has opened new sources of revenue and has given great momentum to the stock. Amazon has had a great run and should continue to go up from here.

- This is an expensive stock and options are expensive as well. This trade makes sense since we are benefiting from high option prices and by shorting 2 calls against our long , we are reducing the capital requirement for the trade. The trade could be profitable within a large price range and only costs about 2% of the price of the underlying.

- This Trade cannot be closed prior to the expiration.

(Note) The loss potential is unlimited in this trade since we are short 2 calls against 1 long call which makes the risk unlimited. Please check with your broker for your exact margin requirements.

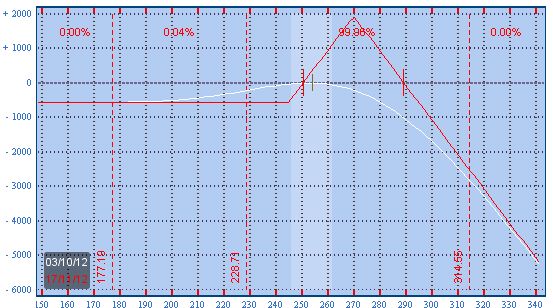

Trade: Buy 1 Nov $245/$270 Ratio Call spread for less than $5.50

- Buy 1 Nov $245 Call for $17.70

- Sell 2 Nov $270 Call for $6.10

Breakeven & Profit/loss analysis

- Breakeven at $250.50 and $289.50

- Profit up to $19.50 between $250.50 to $270 , Profit drifts down from $270 to $289.50, Max profit $19.50 at $270

- Lose up to $5.50 between $250.50 and $245 and $289.50 and $292.25 , Max loss is unlimited above $292.25

The payoff table is presented below:

Trade

- Buy 1 November $245.00 Call at $17.70

- Sell 2 November $270.00 Call at $6.10

- For a net debit of $5.50

Profit/Loss Analysis

- Breakeven at $250.50 and $289.50

- Maximum profit is $1,950.00 at strike of $270.00

- Maximum loss is unbounded

Closing Summary

- Sold 1 November $245.00 Call at $0.00

- Bought 2 November $270.00 Call at $0.00

|

|

Position closed on 11/21/2012 at price of $0.00 with a -100.00% loss in 49 days.