Put Spread on LEN on 10/15/2012

Lennar Corporation is a homebuilder and a provider of financial services. The Company, through its Rialto Investments (Rialto) segment, is an  investor in distressed real estate assets. The Company’s home building operations include the construction and sale of single-family attached and detached homes, as well as the purchase, development and sale of residential land directly and through unconsolidated entities in which it has investments. The Company has grouped its homebuilding activities into five segments: Homebuilding East, Homebuilding Central, Homebuilding West, Homebuilding Southeast Florida and Homebuilding Houston. Its financial services segment provides mortgage financing, title insurance and closing services for both buyers of the Company’s homes and others.

investor in distressed real estate assets. The Company’s home building operations include the construction and sale of single-family attached and detached homes, as well as the purchase, development and sale of residential land directly and through unconsolidated entities in which it has investments. The Company has grouped its homebuilding activities into five segments: Homebuilding East, Homebuilding Central, Homebuilding West, Homebuilding Southeast Florida and Homebuilding Houston. Its financial services segment provides mortgage financing, title insurance and closing services for both buyers of the Company’s homes and others.

Stockwinners is bearish on this name for the following reasons:

- The rally in this name is already over extended and it seems like the sentiment of the market is shifting negative.

- If the housing market had really recovered, there wouldn’t be any QE. Remember that this QE was focused on buying MBS on a monthly basis which is good indication of the current status of sector. Most of the names in this space including LEN, have had tremendous run since last October and a healthy correction is reasonable.

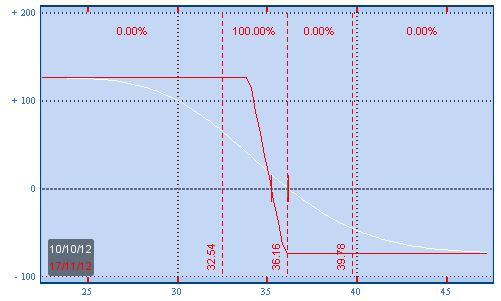

Trade: Buy 1 Nov 36/34 put spread for less than .75

- Buy 1 Nov $36 put for 1.58

- Sell 1 Nov $34 put for .84

Breakeven & Profit/Loss analysis

- Breakeven on $35.25 by Nov Expiration

- Profit up to $1.25 between 35.25 and 34, Max profit 1.25 below 34

- lose up to .75 between 35.25 to 36, max loss .75 above 36

The payoff table is presented below :

Trade

- Buy 1 November $36.00 Put at $1.58

- Sell 1 November $34.00 Put at $0.84

- For a net debit of $0.74

Profit/Loss Analysis

- Breakeven at $35.26

- Maximum profit is $126.00 at strike of $34.00

- Maximum loss is ($74.00) at strike of $36.00

Closing Summary

- Sold 1 November $36.00 Put at $1.50

- Bought 1 November $34.00 Put at $0.29

|

|

Position closed on 11/15/2012 at price of $1.21 with a 63.51% gain in 31 days.

Updates

11/15/2012 10:37:32 AM

We are closing this position and taking profit. please adjust your stop-loss if you decide to stay on this trade