Call Spread on MSFT on 9/24/2012

Microsoft's ambitions are anything but small. The world's #1 software company develops and sells a variety of products used by consumers and  businesses. Its core products are the ubiquitous Windows PC operating system and the Office business productivity application suite that are sold in part through PC makers such as Acer, Lenovo, Dell, Hewlett-Packard, and Toshiba, who pre-install the software on devices. Microsoft also sells directly online and through resellers. Other products include enterprise applications (Microsoft Dynamics), server and storage software, video game consoles (Xbox), and digital music players (Zune). The company also makes mobile phone software (Windows Phone).

businesses. Its core products are the ubiquitous Windows PC operating system and the Office business productivity application suite that are sold in part through PC makers such as Acer, Lenovo, Dell, Hewlett-Packard, and Toshiba, who pre-install the software on devices. Microsoft also sells directly online and through resellers. Other products include enterprise applications (Microsoft Dynamics), server and storage software, video game consoles (Xbox), and digital music players (Zune). The company also makes mobile phone software (Windows Phone).

Stockwinner is bullish on this name for the following reasons:

- The long waited windows 8 will be released by mid-October and will force many users to upgrade.

- The new Nokia phone with Windows 8 mobile platform is expected to be released by early November. The hype and buzz will help lift the stock to break out of its long term resistance level around $33.

- Their tablet, Surface is going to generate new revenue streams previously unavailable to MSFT . This new revenue will begin to reflect in the stock price and lift the price from current levels.

- The volatility on this name is fairly low and options can be bought at a fairly low price.

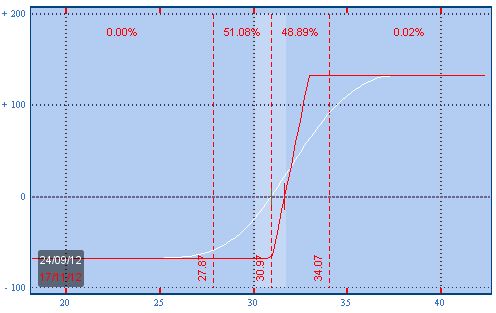

Trade: Buy 1 Nov $31/$33 call spread for less than $.60

- Buy 1 Nov $31 call for $.82

- Sell 1 Nov $33 call for $.22

Breakeven & Profit /Loss analysis

- Breakeven at $31.60 by Nov expiration

- Profit up to $1.40 between $31.60 and $33, Max profit $1.40 above $33

- Lose up to $.60 between $31.60 and $31, Max loss $.60 below $31

The payoff table is presented below:

Trade

- Buy 1 November $31.00 Call at $0.82

- Sell 1 November $33.00 Call at $0.22

- For a net debit of $0.60

Profit/Loss Analysis

- Breakeven at $31.60

- Maximum profit is $140.00 at strike of $33.00

- Maximum loss is ($60.00) at strike of $31.00

Closing Summary

- Sold 1 November $31.00 Call at $0.00

- Bought 1 November $33.00 Call at $0.00

|

|

Position closed on 11/21/2012 at price of $0.00 with a -100.00% loss in 58 days.